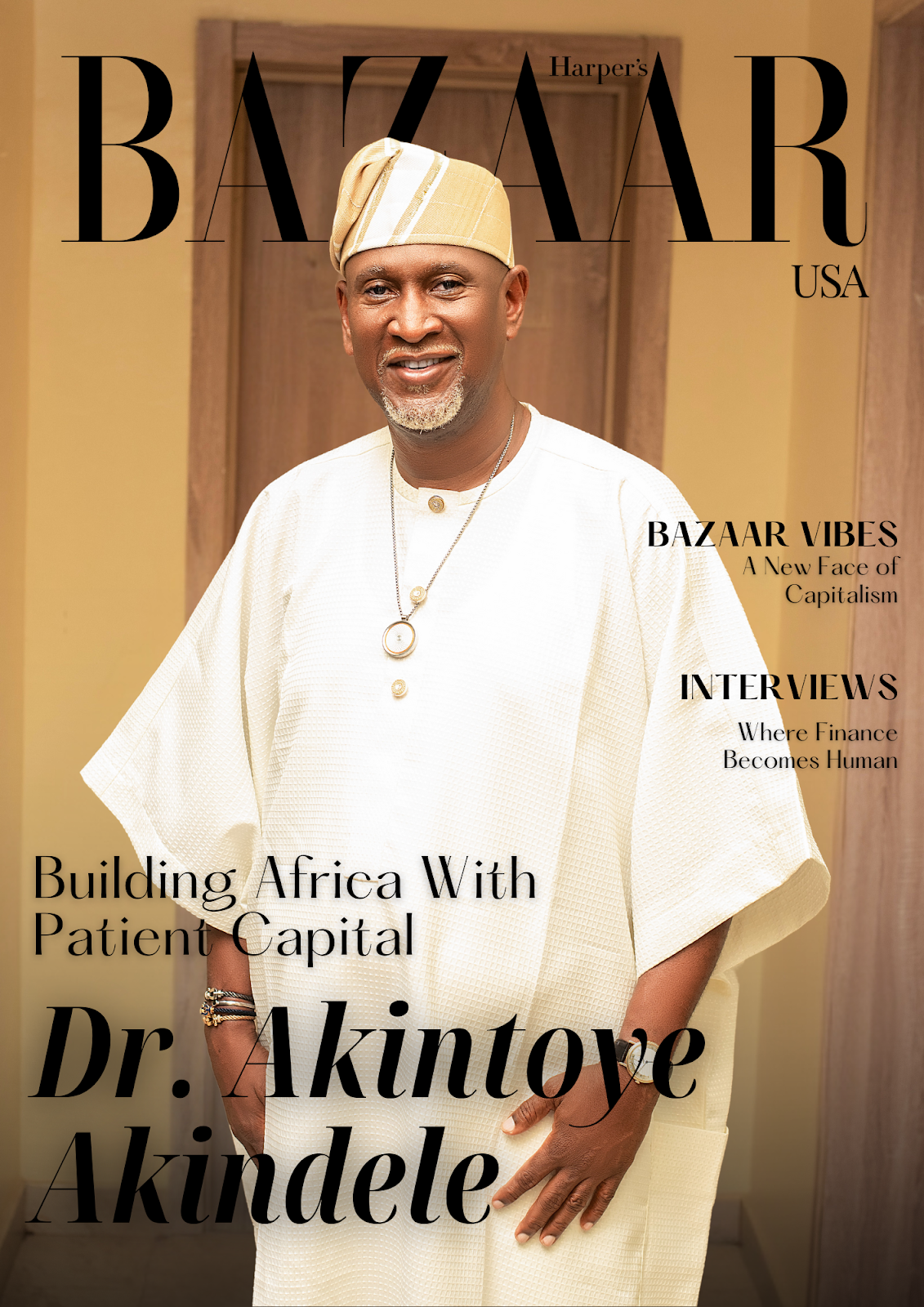

In a global financial system often driven by speed, exits, and short-term performance, Dr. Akintoye Akindele CFA, DBA, FICA (Dr Akindele) offers a radically different vision—one where capital is patient, values are central, and success is measured in lives transformed as much as returns generated. Investor, institution builder, technologist, and founder of Platform Capital (The Platform Capital), Dr. Akindele has dedicated his career to proving that finance can be both highly profitable and deeply human.

His journey is not a straight line, but a deliberate accumulation of disciplines—engineering, technology, and finance—woven together by a singular purpose: to help Africa move beyond potential into sustainable, inclusive prosperity.

Building a Portfolio of Expertise

Dr. Akindele’s professional story began in the mid-1990s with a degree in Chemical Engineering from Obafemi Awolowo University, where he graduated with honors. From the outset, he was driven by a vision larger than himself. He saw a continent rich in resources yet constrained by its dependence on exporting raw materials. His early ambition was to help build the infrastructure that would allow Africa to process, manufacture, and add value locally.

Engineering taught him how physical systems are designed and constructed. But as his thinking evolved, he recognized a deeper truth: the real architecture of development is financial.

Rather than abandoning his technical roots, Dr. Akindele expanded his skill set. While advancing through banking and investment roles, he systematically built a technology foundation, earning certifications in Microsoft systems, Cisco networking, and database management. Long before “digital transformation” became a buzzword, he believed technology would be the great equalizer for emerging markets.

At the same time, he deepened his financial expertise, becoming a CFA Charterholder and later earning a Doctorate in Business Administration with a focus on finance. These parallel tracks—engineering, technology, and finance—eventually converged into a unique professional identity, equipping him to navigate complex private equity transactions and, ultimately, to establish Platform Capital.

His career, by design, has never been linear. Each discipline was chosen to solve a different piece of the African development puzzle: how to build scalable, resilient, and enduring institutions using patient, purposeful capital.

The Search for Patient Capital

As Dr. Akindele immersed himself in Africa’s investment landscape, a critical gap became clear. Most capital entering the continent came with short time horizons—five to seven years—focused primarily on quick exits rather than institution building. While such models may work in mature markets, he believed they were fundamentally misaligned with Africa’s long-term needs.

Africa, in his view, requires capital that can breathe, grow, and compound over decades.

This conviction was reinforced by a deeply personal influence: his father’s question, “What is the testimony of your life?” That question became Dr. Akindele’s compass. He wanted his life’s work to demonstrate that finance could have a soul—that capital and impact could move together, hand in hand.

Out of this belief was born a mission that continues to guide everything he does: to help shape a form of capitalism that is patient, restorative, and fundamentally human.

Platform Capital: A Firm Built Without Silos

Platform Capital was designed as an expression of this philosophy.

Operationally, the firm is stage-agnostic, sector-agnostic, size-agnostic, and region-agnostic. This allows it to back exceptional founders and transformative ideas wherever they emerge—from early-stage startups raising $500,000 to growth companies seeking $50 million, across technology, agriculture, healthcare, education, energy, and beyond.

Very few investment firms on the continent operate with this level of breadth. Yet this flexibility is not accidental. It is anchored in a strong internal value system summarized by the acronym BLACK:

- Being your brother’s keeper

- Loyalty

- Authenticity

- Capacity (energy, speed, resilience, and competence)

- Knowledge

These values are not theoretical. They shape how Platform Capital selects partners, structures relationships, and supports founders through cycles of growth and challenge.

For Dr. Akindele, values are not a constraint on performance. They are the foundation of it.

Conviction-Led Investing

Unlike traditional firms that operate within narrow theses, Platform Capital follows conviction.

Projects are evaluated not only on market size or financial projections, but on the quality of the founder, the depth of the problem being solved, and the potential to build an enduring institution. This approach allows the firm to discover overlooked opportunities and support entrepreneurs who may not fit conventional venture or private equity profiles.

Dr. Akindele describes this model as combining agility with patience—the ability to spot opportunity anywhere, and the willingness to nurture it for the long term.

What motivates him most is proving, through real-world results, that this approach works. That a model unconstrained by silos yet anchored in unwavering values is not only ethical, but exceptionally effective.

Redefining Success

Perhaps Dr. Akindele’s most profound departure from conventional thinking lies in how he defines success.

To him, success means love.

It is the measure of how deeply we have cared for and lifted others. It is not a single financial figure, but a dual legacy: how much value you create and how many lives you meaningfully improve. Extraordinary returns that leave people untouched, he believes, miss the point entirely.

True success is tangible. It has names, faces, and stories. It appears in improved healthcare outcomes, expanded access to education, dignified jobs, and inclusive economic participation. It is about building institutions that endure and continue serving long after their founders are gone.

In this worldview, profit and purpose are not opposites. They are inseparable.

A Milestone That Reflects the Mission

One milestone captures this philosophy with clarity: Platform Capital has directly touched approximately 1.2 million lives (Impact Foundation) through its investments and initiatives.

This is not an abstract estimate. It reflects verifiable impact across healthcare, education, job creation, and community empowerment.

For Dr. Akindele, this achievement reinforces a central belief: for capitalism to survive and truly thrive, it must evolve. It cannot remain extractive or short-sighted. It must become restorative, patient, and fundamentally human.

The 1.2 million lives touched stand as evidence that when capital is deployed with intention, care, and a long-term commitment to people and planet, it becomes one of the most powerful forces for sustainable transformation.

Financing Africa’s Sustainable Future

Looking ahead, Dr. Akindele is focused on pioneering innovative financing mechanisms that align capital with systemic change.

A major area of focus is the development of carbon and social impact credits as a dual-benefit financing tool for Africa’s sustainable development. Under this model, a single project can generate two complementary revenue streams:

- Carbon credits from reducing or avoiding emissions

- Social impact credits from measurable community benefits

For example, a clean cookstove initiative can generate carbon credits by reducing charcoal usage, while also producing social impact credits due to lower respiratory illness, reduced deforestation, and time saved for women and children. Corporations seeking to meet ESG commitments find value in both dimensions.

This structure enhances project viability and scalability, unlocking private investment for renewable energy, sustainable infrastructure, regenerative agriculture, forest conservation, and clean water—sectors that often struggle to attract sufficient funding.

Equally important is the creation of robust verification frameworks to ensure that these credits represent real, additional, and lasting impact.

To Dr. Akindele, this is not just financial innovation. It is a practical pathway to financing a future where Africa’s growth is inclusive, resilient, and environmentally responsible.

A Legacy of Purposeful Capital

Dr. Akintoye Akindele’s life work is a living argument that Africa does not need to choose between growth and humanity. It can—and must—have both.

Through Platform Capital and his broader impact initiatives, he continues to demonstrate that patient capital, anchored in strong values and long-term thinking, can build enduring institutions, generate outstanding returns, and transform lives at scale.

His testimony is still being written. But its central message is already clear:

Capital can have a soul. And when it does, it changes everything.